If you’re thinking about refinancing your mortgage, applying for a new credit card or taking out a personal loan, you should first know your credit score. Because when you apply to take on any form of debt or credit, lenders will check your credit score to determine whether you’re a good credit risk. So knowing your own score in advance will tell you if you’re likely to get the credit or loan you want.

But how do you check your credit score? There are a number of ways, some of which are even free or included in other services you may already be able to access at no additional cost.

Credit cards with credit scores

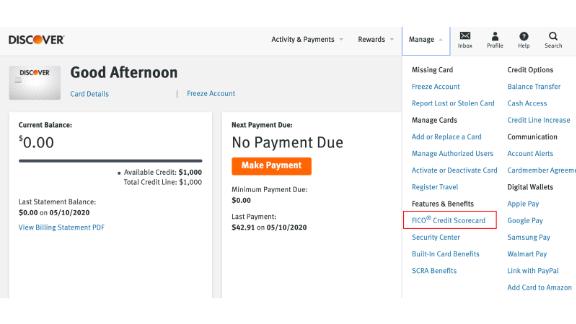

In recent years, many credit card issuers began including free credit scores to customers who have their credit cards. If you have a credit card with American Express, Chase, Citibank, Capital One or Discover, you likely already have access to your credit score.

In order to check your credit score through a credit card, you’ll need to access your online account for that card through the issuer’s website. Once you’ve logged in, look around for a link to credit scores — it may be in a menu or on a sidebar.

It’s important to keep in mind that not all credit scores are the same. There are two main credit scoring systems — one is called FICO and the other is VantageScore. Both provide a three-digit credit score in the range of 300 to 850, but they use different scoring algorithms and often come up with different results.

In addition, credit scores are calculated based on the information in your credit report, and there are three separate credit reporting agencies: Experian, Equifax and TransUnion. Since the information on your credit report is likely to vary slightly among these three agencies, your credit scores will vary as well.

So if you have two or more credit cards issued by separate banks and you look up your credit score from each of them, don’t be surprised if your scores are different. But each bank lists which credit scoring model it uses, so once you’ve determined which credit score model is being used, you can read our guide to find out if you have a good credit score.

Credit score and credit report services

If you don’t have a credit card or your issuer doesn’t provide free credit scores, there are other ways to get your score. Some credit monitoring services offer access to both your credit report and credit score. These services usually come with monthly fees but include alerts when your credit is accessed by someone else or if a new account appears on your report.

Monitor your credit with these credit score and credit report offers.

In addition, the three credit reporting agencies themselves offer consumers the option to purchase their own credit scores, along with other credit reporting products. Some offer a free credit score option as part of their other services too.

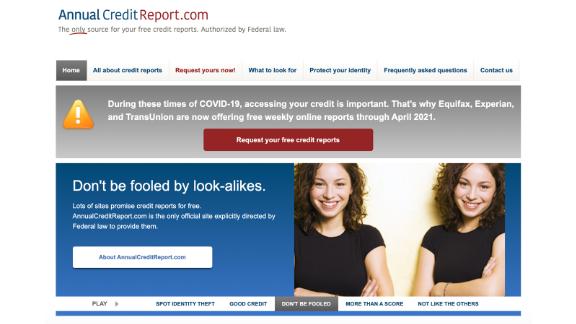

Also, if you only need your credit report itself and not your credit score, federal law requires the credit reporting agencies to give you a free copy of your report once every 12 months when you request it. This will not include a credit score but does show all of your credit accounts along with their current status, any past late payments and other info that appears on your credit report.

There’s one central website that all three credit reporting agencies use to provide these free annual reports — go directly to annualcreditreport.com to make sure you’re using the legitimate site. Also, as a result of the coronavirus pandemic, all three agencies are currently offering free weekly online reports at the site through April 2021.

Does checking your credit score hurt it?

It’s a common misconception that your credit score will drop if you check it. In fact, checking your score or report won’t hurt your credit at all. That’s because when you look at your credit report or credit score, it creates what’s known as a “soft inquiry.” Soft inquiries appear on your report as a record of it having been accessed but are not factored into your credit score itself.

On the other hand, “hard inquiries” are added to your credit report when you’re requesting a new line of credit and a lender looks at your credit report to determine whether to approve you. Hard inquiries do get factored into your credit score, so when you apply for a new credit card or to refinance your mortgage, you can expect your credit score to take a small, though temporary, drop.

Related: Does opening a new credit card hurt your credit score?

How often should you check your credit score?

Many people don’t realize that your credit score isn’t a fixed number. Whenever there’s a change to your credit report, your credit score will change as well.

Therefore, you shouldn’t just check your credit score once and assume it’ll stay the same for months on end. Every time you pay down your debt, even just partially, your score will change a bit. It’ll also drop if you miss a required monthly payment or are more than 30 days late paying.

On the other hand, you probably don’t need to check your credit score too often. A good rule of thumb is to keep an eye on it every few months, and especially when you’re getting ready to apply for new credit. Credit reporting agencies do make mistakes, and your credit info can also fall into the wrong hands, so knowing your score is a good way to know if negative information suddenly shows up on your report.

In the end, your credit score is one of the key factors that a lender will use to determine whether to extend credit to you, along with your income, your ability to pay and your other existing debts. So checking your credit score on a regular basis is a smart financial move.

Check your credit score now and keep an eye on your credit with these offers.

Read other stories in our “Myths about credit” series:

Looking for a new credit card? Read CNN Underscored’s guide to the best credit cards of 2020.

Get all the latest personal finance deals, news and advice at CNN Underscored Money.

"score" - Google News

September 04, 2020 at 03:05AM

https://ift.tt/2QUAJZ3

Myths about credit: How can you check your credit score? - CNN

"score" - Google News

https://ift.tt/2OdbIHo

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Myths about credit: How can you check your credit score? - CNN"

Post a Comment