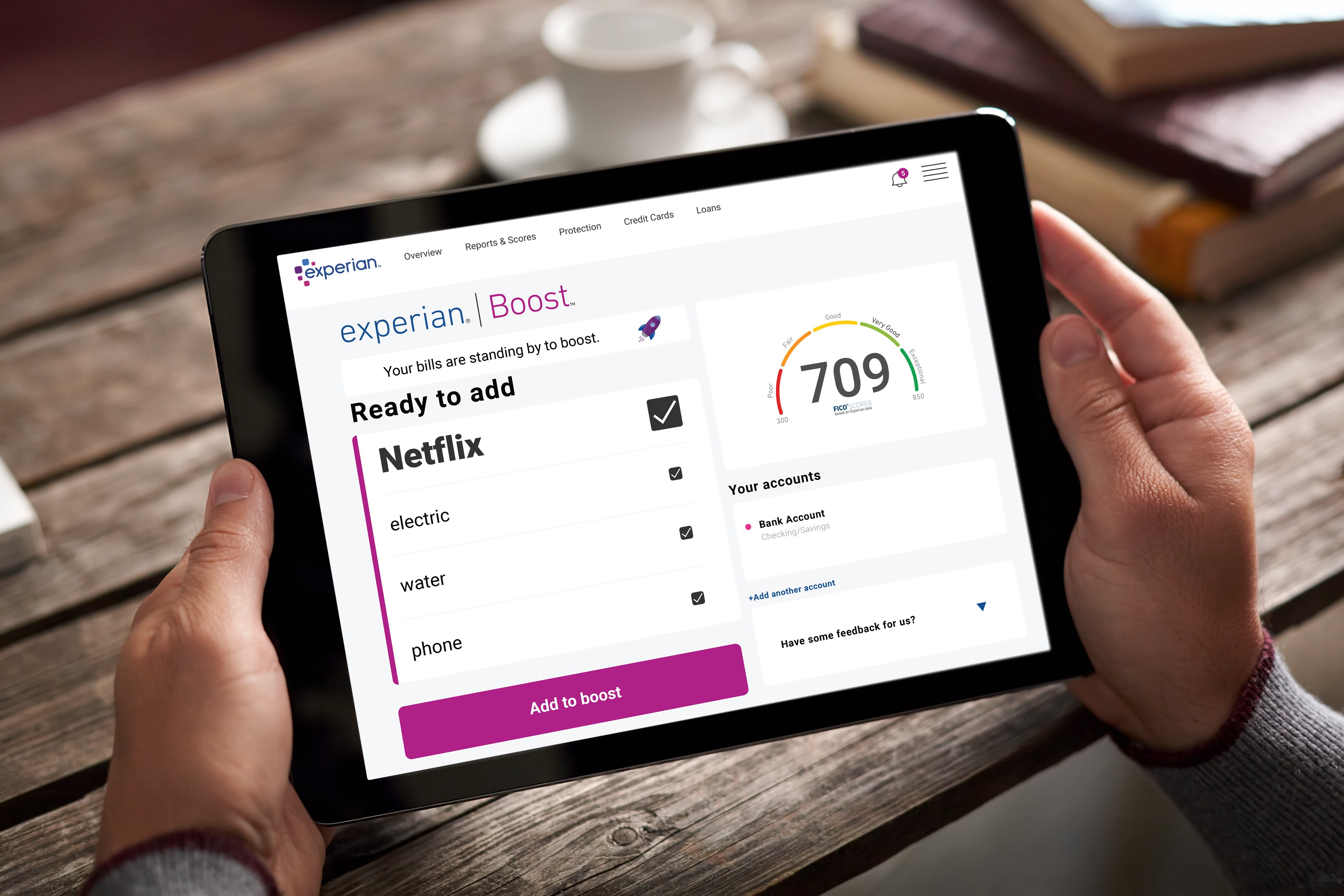

Starting today, July 27, consumers can now include their Netflix on-time payment history on their Experian Boost accounts, which can help improve their credit scores.

"We know consumers are watching more television, and we also know that many consumers are also cutting cable and moving to streaming services, so it's the right time for us to look at including a service like this," Jeff Softley, D2C president at Experian Consumer Services, tells CNBC Select.

Experian Boost is a free service that helps you improve your credit score by paying monthly bills on time. Prior to the Netflix addition, you could only add utility and phone bills, including internet, cable, gas, electric and water bills. Plans to expand to additional streaming providers are also in the works.

In just over a year, more than 4 million consumers have already connected their accounts to Experian Boost, resulting in over 29 million points boosted to date, Softley says.

On average, users see a 13-point increase in their FICO® Score 8, based on Experian data. Results may vary and you may not see an improvement in your score. Also, this service doesn't affect your credit score with the other two credit bureaus — Equifax and TransUnion.

New Experian Boost consumers can already start to link Netflix payments, while the option will roll out to existing users over the next few weeks.

Below, CNBC Select reviews how Experian Boost works and other new financial management tools from Experian.

How Experian Boost works

Getting credit for eligible bills with Experian Boost is easy and free. Simply follow these three steps:

- Connect the bank account(s) you use to pay your bills.

- Choose and verify the positive payment data you want added to your Experian credit file.

- Receive an updated FICO score.

You can link positive payment data as far back as 24 months. Late payments aren't reported through this service, however you should pay any outstanding bills as soon as possible since your creditor can send negative information to the credit bureaus.

Other features of Experian Boost include access to your Experian credit report and FICO score, both updating every 30 days. You'll also receive Experian Credit Monitoring and alerts for changes on your credit report, such as new account openings in your name and balance updates.

Additional financial tools from Experian

Experian is now offering a new financial management hub inside the CreditWorks Basic and Premium products (the basic plan is free and the premium costs $4.99 the first month, then $24.99 each month after). This hub can help you manage your spending and offers financial tips to keep you on track.

Some key features include:

- Account balance monitoring and alerts

- Recommendations on how to lower bills and manage debt, such as using a balance transfer card

- Categorization of spending

- Trending data for net worth, income and cash flow

Targeted savings opportunities and personalized savings estimates based on your credit file are expected to be added in the near future.

Don't miss:

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the CNBC Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

"score" - Google News

July 27, 2020 at 05:25PM

https://ift.tt/39DEx9G

Experian Boost now lets you add on-time Netflix payments to raise your credit score - CNBC

"score" - Google News

https://ift.tt/2OdbIHo

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Experian Boost now lets you add on-time Netflix payments to raise your credit score - CNBC"

Post a Comment