Morsa Images

With the release of the 1H23 report, I am revisiting my original analysis on NewLake Capital Partners (OTCQX:NLCP) published on this site in March. The long-term investment thesis hasn’t changed, and readers who wish to understand the company better can refer to my previous article.

Despite underperforming the broader indexes, my total return since initial coverage of NLCP is in positive territory, which I evaluate as a good result considering the challenges faced by the industry in the meanwhile. While my buy rating slightly missed the bottom, the price seems to have finally firmed up, with the market fully baking in the ongoing struggles of a few MSOs (including NLCP tenants).

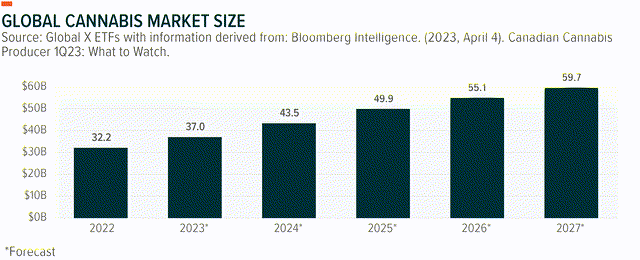

Long-term, pot stocks remain an opportunity. According to Forbes, the market is forecasted to continue its double-digit growth (~14% CAGR) and cross the $50 billion mark in 2028. The value also aligns with below Bloomberg data, which considers the US market to be 80% of the worldwide total.

globalxetfs.com / Bloomberg

Legislation progresses

While the market may have chosen to focus on the obvious negatives, such as inflation driving up MSO costs, pricing issues from over-competition and the black market, and the frail financial profile of entities still locked out from the traditional banking system, not everything has been bad news.

On April 27th, lawmakers reintroduced the SAFE Banking Act. While the plan is proceeding slower than anticipated, with clashes between Democrats and Republicans over its details, investors should remain focused on the bigger picture. With public opinion overwhelmingly favoring legalization, political attention remains high in Washington. It has never been higher. While a law about basic financial services to the marijuana industry is already long overdue, it won’t be delayed forever.

While federal reforms await, states are acting. On May 31st, Minnesota signed into law the legalization of adult-use (recreational) marijuana, becoming the 23rd state to allow it. Ohio, Pennsylvania, and Florida could soon follow in Minnesota’s footsteps.

Industry and NewLake’s progresses

Even more important than the political football about the cannabis issue, the 2Q23 earnings call of NewLake gave new confidence that the problems affecting MSOs could finally start turning around.

The environment for cannabis operators is showing some signs of stabilization. Marginal capacity is coming out of certain markets, prices are firming in some markets, and the benefits of cost-cutting and business rationalization will begin to improve operators’ operating cash flow. – (Anthony Coniglio, 2Q23 NLCP earnings call)

While the industry as a whole may not be out of the woods yet, the progress made by NLCP on its internal issues was remarkable. We were aware of the ongoing collection issues with Revolutionary Clinics at the time of my March analysis. During Q2, NLCP continued to draw from Revolutionary Clinics’ security deposit but updated investors that significant progress was made in finding a permanent solution with the tenant. The company expects to sign a deal in Q3. With Revolutionary Clinics representing 10% of the NLCP’s revenue, any agreement would be a massive positive.

The company also continues to monitor the situation with tenant Calypso, who has reportedly laid off 75% of its workforce since 2021. Although somewhat problematic, the company continues to pay rent as due. Here, we look for any positive development in Pennsylvania’s legislation to provide relief.

NewLake’s 1H23 results

Despite the challenges, I view NewLake’s 2Q23 results favorably. Revenue for the second quarter increased 8.2% YoY to $11.4 million, and AFFO totaled almost $10 million.

The company continues to cover dividends ($8.3 million) and share repurchases ($0.71 million) with operating cash flow, which is already net of the situation with Rev Clinics. I estimate that the AFFO payout for FY23 will align with the Q2 ratio of 85% but could also slightly improve from here. Considering NLCP targets distribution of 80% to 90% of its AFFO, there is limited room for further increases. However, the current dividend is well covered, and a cut is not likely unless new, currently undisclosed tenant issues emerge. With escalators and limited capital deployment, the company can withstand the current distribution level even if things take an unexpected turn for the worse with Rev Clinics. However, foreclosure is not my base case here. Even though I expect NLCP to hit the low-end guidance of $39.8 million, regardless of whether a solution with Rev Clinics is attained within the quarter, signing a deal could lead to an upside in FY23 AFFO.

As of June 30th, NLCP held virtually no debt, with only $1 million in fixed-rate debt (4% interest rate) due in 2024 and about $1.0 million in borrowings under the company’s revolving facility (5.65% interest rate) and $89.0 million in funds available to be drawn. The company also held over $40 million in cash and cash equivalents, with $22.8 million committed to fund tenant improvements.

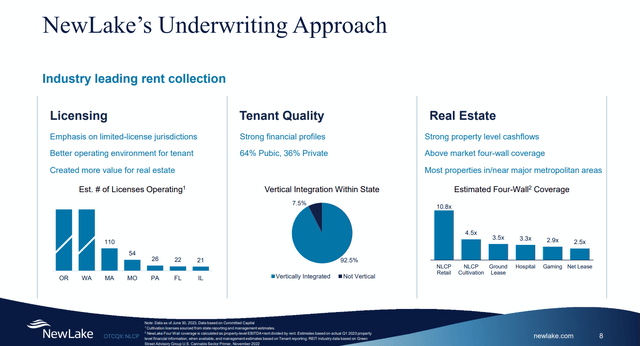

The company’s Q2 investment activity remained muted, and NLCP only funded $1.6 million in tenant improvements. The only acquisition to date in 2023 remains a parcel of land in Missouri that Bloom Medicinal could use to expand its facility. NLCP has taken a careful wait-and-see approach with its remaining liquidity, which I deem appropriate at this juncture of the industry’s cycle. New shares issuance remains impracticable at this valuation, so the company must maintain the strictest possible underwriting standards. The company’s strategy to focus on limited-license jurisdictions should prove correct over the long term and pay off.

NLCP Aug23 presentation

The company holds triple-net long-term leases with an average of 14.5 years remaining and 2.7% escalators. Tenants have among the best four-wall coverage of the entire triple-net spectrum.

The company also continues to evaluate the possibilities of an uplisting, although that could be on the Toronto Stock Exchange (TSX).

Valuation

With a portfolio of recently acquired or developed state-of-the-art cultivation facilities and no debt, I see book value as the best proxy of NLCP’s NAV and fair value. I am confident in reconfirming the $20 target previously assigned. NewLake shares remain deeply undervalued and represent an excellent buy below $14 per share, giving investors a 30%+ margin of safety.

With about 21.7 million (fully diluted) shares out, FY23 AFFO per share should total $1.83 - $1.87. I am going for the middle of the range here and forecasting $1.85. It translates to less than an 11x multiple against my indicated fair value. At 7.2x, shares are a bargain and significantly cheaper than peer Innovative Industrial Properties (IIPR), which is changing hands at almost 10x fwd AFFO.

The current dividend yield of almost 12%, considerably higher than IIPR, also makes little sense. Although I expect NLCP to remain a high-yielder, my fair value assumes a $1.60 fwd payout, equal to 87% of AFFO, and an 8.0% dividend yield.

Conclusions

Despite favorable long-term trends and high growth potential, the US cannabis market has arguably got ahead of itself, with several MSOs being in a problematic situation caused by rising costs and stagnating prices. However, the mentioned dynamics are a typical stage of nascent industries, and should not discourage prospective investors. My assessment highlights that NewLake Capital Partners has the potential to overcome the current difficulties.

In my opinion, being a small player vs. IIPR and a relatively new kid on the block, the slump has disproportionately hit NLCP, creating an exciting opportunity for income investors with above-average risk tolerance.

With signs of stabilization in the sector and progress in resolving the issues within the company portfolio, the pendulum could now be swinging toward favoring investment in NCLP. Despite the positive results posted in Q2, the company remains underfollowed, so the market has barely noticed the improvements yet. I continue to see NLCP shares undervalued and rate them a BUY.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

"course" - Google News

August 13, 2023 at 11:45PM

https://ift.tt/coPBxMF

NewLake Capital Partners: Stay The Course (OTCMKTS:NLCP) - Seeking Alpha

"course" - Google News

https://ift.tt/ki0Qlan

https://ift.tt/74ltHmn

Bagikan Berita Ini

0 Response to "NewLake Capital Partners: Stay The Course (OTCMKTS:NLCP) - Seeking Alpha"

Post a Comment