AlexSecret

This article was published at iREIT™ on Alpha on Saturday June 3, 2023.

The artificial intelligence ("A.I.") craze that took over markets last week was crazy to see…and essentially represented a microcosm of what’s been going on with the broader markets throughout 2023 thus far.

We saw Nvidia Corporation (NVDA) post earnings which blew away analyst estimates, causing that stock to spike by approximately 26.5%.

This isn’t a stock that I follow closely. It’s a speculative growth stock that pays a paltry dividend, so it’s not really something that I’m interested in owning at this point in my life. However, a couple of the analysts on my team who own shares and cover the stock closely told me that NVDA’s report was a thing of beauty.

They tell me that Nvidia is dominating the artificial intelligent semiconductor market right now and that this trend has a long-term runway.

Truth be told, I don’t know if I believe in this A.I. hype.

I’ve seen bubbles blow up like this in the past…and they’ve always popped.

Maybe A.I. will be different.

I suppose there’s always that possibility.

Who knows? Maybe A.I. will totally revolutionize the world and companies who support that growth will generate asymmetric returns for decades.

NVDA posted Q2 sales guidance that was roughly $4 billion higher, or 50% above, prior to Wall Street’s estimates. I don’t have to follow the stock to know that beats like that don’t come along very often. And with that being said, I’m not surprised to see the stock’s positive reaction.

But, longer term, I think that jumping onto this A.I. bandwagon is a risky bet due to the sky-high valuations associated with stocks like NVDA, and I’d much rather continue to focus on quality and value in unloved areas of the market.

An Extremely Narrow Broad Market Rally

On top of Nvidia’s results, another semiconductor, Marvell Technology, Inc. (MRVL) jumped 44.65% last week, pushing its year-to-date gains up to 82.02%.

Once again, A.I. was the driving force here, with its management team calling for its A.I. related growth to be in the triple digits during its fiscal 2024.

Last week, stocks related to artificial intelligence added more than $300 billion to their market caps, alone.

And this is the perfect segue to the major theme that has played out during 2023 thus far: one of the most narrow broad market rallies that I’ve ever seen.

On a year-to-date basis, the S&P 500 (SP500) is up by approximately 9.5%. And the tech-heavy Nasdaq Composite Index (COMP.IND) is leading the way, up by nearly 25%.

Yet, when you look at the underlying performance of the companies that make up each of these indexes, you’ll notice that the vast majority of this positive performance is being driven by just a few mega-cap stocks that have outperformed the market during 2023.

Remember, the major indexes are market cap weighted and therefore, their largest holdings have an outsized impact on performance.

-

Apple (AAPL): Market Cap ($2.76 trillion) up by 40.27% on a year-to-date basis; dividend yield is 0.70%.

-

Microsoft (MSFT): Market Cap ($2.48 trillion) up by 38.95% on a year-to-date basis; dividend yield is 0.82%.

-

Alphabet (GOOGL): Market Cap ($1.59 trillion) up by 39.82% on a year-to-date basis; dividend yield is 0.00%.

-

Amazon (AMZN): Market Cap ($1.23 trillion) up by 39.96% on a year-to-date basis; dividend yield is 0.00%.

-

Nvidia: Market Cap ($963.2 billion) up by 172.06% on a year-to-date basis; dividend yield is 0.04%.

-

Meta Platforms (META): Market Cap ($671.5 billion) up by 110.07% on a year-to-date basis; dividend yield is 0.00%.

-

Tesla (TSLA): Market Cap ($612.3 billion) up by 78.7% on a year-to-date basis; dividend yield is 0.00%.

First of all, I want to say congratulations to everyone who owns these stocks.

You aren’t seeing any real estate investment trusts, or REITs, on this list, but I’m not bitter.

Looking at the stocks above, you’ll notice that only 3 of them pay dividends, and all of those 3 stocks offer yields less than 1%.

Simply put, these likely aren’t the types of stocks that conservative income-oriented investors (including myself) are going to be interested in…and that’s okay.

Different strokes for different folks, as I like to say.

REITs don’t offer the fundamental growth prospects that these high-flying tech stocks do.

But, I’d also argue that they’re much more stable, reliable, and predictable…especially when we’re talking about cash flows and most importantly, dividend yields.

For me, these yields are paramount because they mean that I’m being paid while I wait for REITs to return to the limelight.

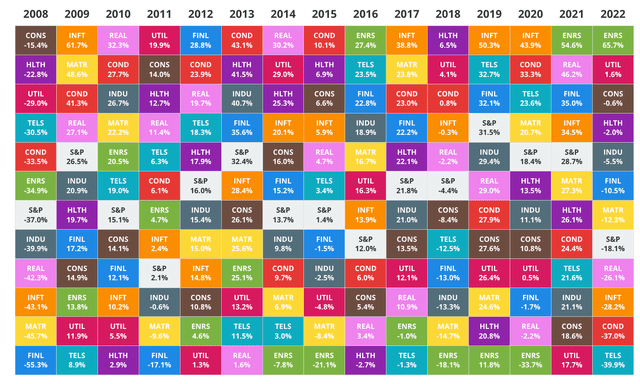

Looking at this chart, you’ll notice that REITs (the pink squares) have been top performers during many of the past 15 years.

Novel Investor

I’m sleeping well at night with my REIT positions because in the stock market, blue chips nearly always bounce back.

Why?

As Benjamin Graham said, “'In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

In other words, so long as fundamentals remain strong, eventually share prices will rise.

No one knows when a sentiment shift will occur in the markets.

But, I don’t worry about that too much. Instead, I let fundamentals be my guiding light and with that being said, I remain confident in the REITs that I own over the long-term.

Mean Reversion Is A Value Investor’s Best Friend

While I’m not bitter about tech’s near-term outperformance, I have heard from a handful of REIT investors who are feeling sour about our favorite sector’s relative underperformance in recent years.

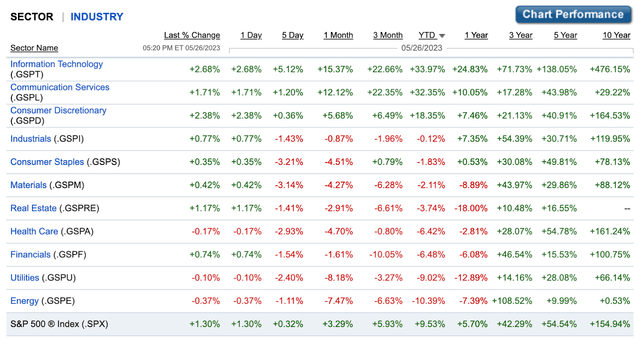

Looking at the chart below, you’ll see that the Real Estate sector is in the red during 2023 thus far.

Fidelity

Hey, it could be worse…we could be overweight Energy stocks.

All joking aside, I get it.

No one likes seeing their holdings lose value and during the last 2 years, that’s been a common occurrence with REITs.

We’ve seen many of the highest quality REITs trend lower during 2022 and 2023; however, I have good news…

This trend is unlikely to last.

Looking at the 2023 returns…from the index and sector-by-sector standpoints…you’ll notice a stark contrast to 2022.

For instance, last year the Nasdaq fell by 33.1% and now it leads the way.

If I were to provide you a snapshot of the sector performance from a year ago, things would look a lot different.

Energy would have been at the top and the technology-driven sectors would have been at the bottom.

During 2022, Energy was the top-performing sector in the market by far, up by 59% and now it’s down double digits.

On the flip side of that coin, Communication Services, Consumer Discretionary, and Information Technology were down by 40.4%, 37.6%, and 28.9%, respectively.

Looking at the chart above, it’s clear that this performance has flipped.

That’s often what occurs in markets.

Irrational sentiment, not logic or rational fundamental analysis, drives share price movement in the short-term.

And when this emotionally driven pendulum swings, it nearly always swings too far into either bull or bear territory…and then the market corrects itself.

This is why value investors tend to win over the long-term.

By ignoring market sentiment, focusing on fundamentals, and buying attractively valued blue chips that are out of favor, we can not only set ourselves up to benefit from ongoing fundamental growth, but also this mean reversion as well (when the pendulum eventually swings back towards fair value).

And this leads me to the most important point that I want to make today: the importance of patience when it comes to benefitting from mean reversion.

REIT Performance Tracking Interest Rates

During 2022, the Real Estate sector was down by 28.5%.

As you can see above, they’re down another 3.7% in 2023.

Unlike beaten down tech, REITs haven’t experienced their bounce back rally.

But, that doesn’t change the fact that REITs are a coiled spring at the moment…and to me, the longer that they stay depressed, the stronger their eventual resurgence will be.

Looking over some of my favorite REITs in the market today, I continue to see strong fundamental support of my bullish thesis.

This weekend I took a look at some of my recent recommendations and I found a bunch of stocks that have underperformed the broader market this year in spite of reliable fundamental growth.

All of these stocks have either “Buy” or “Strong Buy” ratings at iREIT™ because of the discrepancy between their bottom-line growth and their share price movement.

When I see fundamentals rise, but share prices fall…I begin to suspect an irrational market environment.

Then, when I calculate fair value estimates objectively (using fundamental data) and see that they’re far above current share prices, I know that the market is allowing emotion (fear) to dictate its decision making.

Here are 15 examples of blue chip REITs that the market is irrationally discounting:

|

Company |

Ticker |

Industry |

2023 AFFO Growth Est. |

2024 AFFO Growth est. |

2023 YTD gain/loss |

Fair Value Est. |

Margin of Safety |

Dividend Yield |

|

Realty Income |

O |

Net Lease |

2% |

4% |

-8.06 |

$70.30 |

17% |

5.22% |

|

Agree Realty |

ADC |

Net Lease |

3% |

4% |

-8.49 |

$74.00 |

13% |

4.51% |

|

NNN REIT Inc. |

NNN |

Net Lease |

1% |

3% |

-8.56% |

$48.00 |

12% |

5.23% |

|

W.P. Carey |

WPC |

Net Lease |

1% |

4% |

-12.99% |

$80.00 |

15% |

6.27% |

|

Rexford Industrial |

REXR |

Industrial |

14% |

20% |

0.44% |

$60.00 |

9% |

2.79% |

|

Essex Property Trust |

ESS |

Multifamily |

4% |

2% |

-0.44% |

$300.00 |

30% |

4.39% |

|

Camden Property Trust |

CPT |

Multifamily |

4% |

5% |

-6.11% |

$132.50 |

22% |

3.85% |

|

Mid-America Apartments |

MAA |

Multifamily |

8% |

3% |

-6.09% |

$170.00 |

14% |

3.84% |

|

Alexandria Real Estate |

ARE |

Office/Life Sciences |

8% |

9% |

-22.44% |

$170.00 |

34% |

4.33% |

|

Digital Realty |

DLR |

Data Centers |

3% |

6% |

-3.83% |

$150.00 |

34% |

4.93% |

|

Vici |

VICI |

Gaming/Net Lease |

10% |

4% |

-3.84% |

$36.00 |

15% |

5.11% |

|

Boston Properties |

BXP |

Office |

5% |

6% |

-28.34% |

$100.00 |

52% |

8.21% |

|

Federal Realty |

FRT |

Shopping Center |

5% |

5% |

-15.20% |

$120.00 |

27% |

4.96% |

|

Public Storage |

PSA |

Self Storage |

5% |

9% |

4.56% |

$315.00 |

9% |

4.19% |

|

CareTrust REIT |

CTRE |

Healthcare |

9% |

9% |

-1.12% |

$23.00 |

19% |

4.66% |

As you can see, each of these stocks has underperformed the S&P 500’s nearly 10% gains during 2023 thus far.

Most of them have posted negative price movements during the year.

And yet, their 2023 and 2024 AFFO (adjusted funds from operations) growth estimates remain positive.

This is where the disconnect between rational and irrational investors comes into play.

Not only does this positive AFFO growth result in cheap valuations (especially relative to historical averages), but it also supports relatively safe and secure dividend yields…yields that are well above the S&P 500’s 1.54% dividend yield.

Looking at the margin of safeties here, combined with the strong dividends, I see a bunch of opportunities for investors to generate double digit total returns moving forward (as soon as the market’s sentiment shifts).

In short, the Real Estate sector’s underperformance as of late is providing investors with opportunities to have their cake and eat it too, when it comes to both generating strong passive income and enhancing capital gains potential.

What To Watch For…

Rising interest rates are the main catalyst that is holding REITs down.

Higher rates have been bearish for REITs because of the idea that if investors can receive a ~5% yield with “risk-free” assets, such as U.S. treasury notes (which probably don’t seem so “risk-free” after the recent debt ceiling/default debates) then there is no reason for them to invest in risky assets, like REITs, with similar yields.

But…to me, this is a very short-sighted argument.

First of all, like I said before, I think it’s more likely that treasury rates fall than rise from here.

I think the Fed has already done its heavy lifting and I don’t see them being overly hawkish moving forward.

But, even if we’re in a higher-for-longer scenario with rates hovering in the 5% area, investors who are focused on that yield, as opposed to equity dividend yields, are missing out on the compounding potential of growing dividends over time.

Anyone with a time horizon in the market longer than a few years should really focus on dividend growth because it can protect them from ongoing inflation.

Bond yields don’t protect from annual inflation gains…but a dividend that grows at a rate that matches, or exceeds, the inflation rate can stop the purchasing power of one’s passive income stream from being eroded away by inflation.

With that being said, I continue to prefer the growing passive income provided by equities to the “risk free” yields provided by bonds, and I think anyone who disagrees should take a close look at their budgets in retirement and ask themselves if they’ll be able to maintain their standards of living over the next 5-10 years with inflation in mind?

Furthermore, since the Fed turned hawkish the market has been willing to overlook rising fundamentals across the sector due to fears associated with higher cost of capital hurting profits.

But, REITs are already proving that they can still grow their bottom lines in this interest rate environment and unless you believe that rates are going to continue to soar higher (which isn’t the camp that I’m in) then I don’t think that this bearish argument holds water.

I’m not an economist, but looking at the Fed’s recent minutes and the most up-to-date version of the dot plot, it seems like a pause is in order…and if I had to go out on a limb, I’d say that we’re more likely to see rates fall 2% to the 3% area than we are to see them rise 2% to the 7% area.

To me, a rate cut, or even a prolonged pause, would remove the fear of rising rates from the market and provide the spark that REITs need to rocket higher, back towards cash flow multiples in-line with historical norms.

If the Fed pivots (which seems likely over the next year or two) then REITs will experience the same coiled spring effect that the formerly unloved tech stocks have experienced in 2023.

Admittedly, this bounce probably won’t have the same magnitude of NVDA’s 170%+ rally in 2023; however, they won’t have to bounce that high to meet (and even exceed) the expectations of reasonable investors.

There are more speculative opportunities in the REIT space that have triple digit upside potential in my opinion; however, those carry outsized risk and I doubt that most of my readers are looking to make those types of risky bets.

Thankfully, as I showed above, the negative sentiment surrounding REITs these days is allowing even the most risk-averse REIT investors to put themselves in a situation where strong double digit total returns are possible…while collecting safe and reliable dividend yields.

Stealing another quote from a famous value investor…Benjamin Graham’s protégé, Warren Buffett…during times like this, I believe that investors should be greedy while others are fearful.

Instead of joining the herd and chasing momentum higher and higher, I’ve always done well wearing a contrarian hat.

I get it, the potential of A.I. is great. I hope it revolutionizes the world…increases productivity…and makes all of mankind’s life easier. But, the fact is, real estate isn’t going anywhere.

So, instead of being frustrated with recent underperformance, I think REIT investors are better off focusing on fundamentals, looking for mispriced opportunities, and using near-term weakness to build long-term positions and bolster their passive income streams.

When sentiment shifts and REITs come back into fashion, you’ll be glad that you did.

"course" - Google News

June 10, 2023 at 01:45AM

https://ift.tt/LI5D189

Stay The Course: This Too Will Pass - Seeking Alpha

"course" - Google News

https://ift.tt/SbitIqf

https://ift.tt/E6YgD7K

Bagikan Berita Ini

0 Response to "Stay The Course: This Too Will Pass - Seeking Alpha"

Post a Comment