Americans improved their credit scores in 2020.

The average FICO score increased eight points last year, to an average of 711, according to data from Experian.

But what exactly does that mean?

In the U.S., your credit score is a three-digit number that helps determine how much you pay for credit, which can affect virtually all expenses in your life.

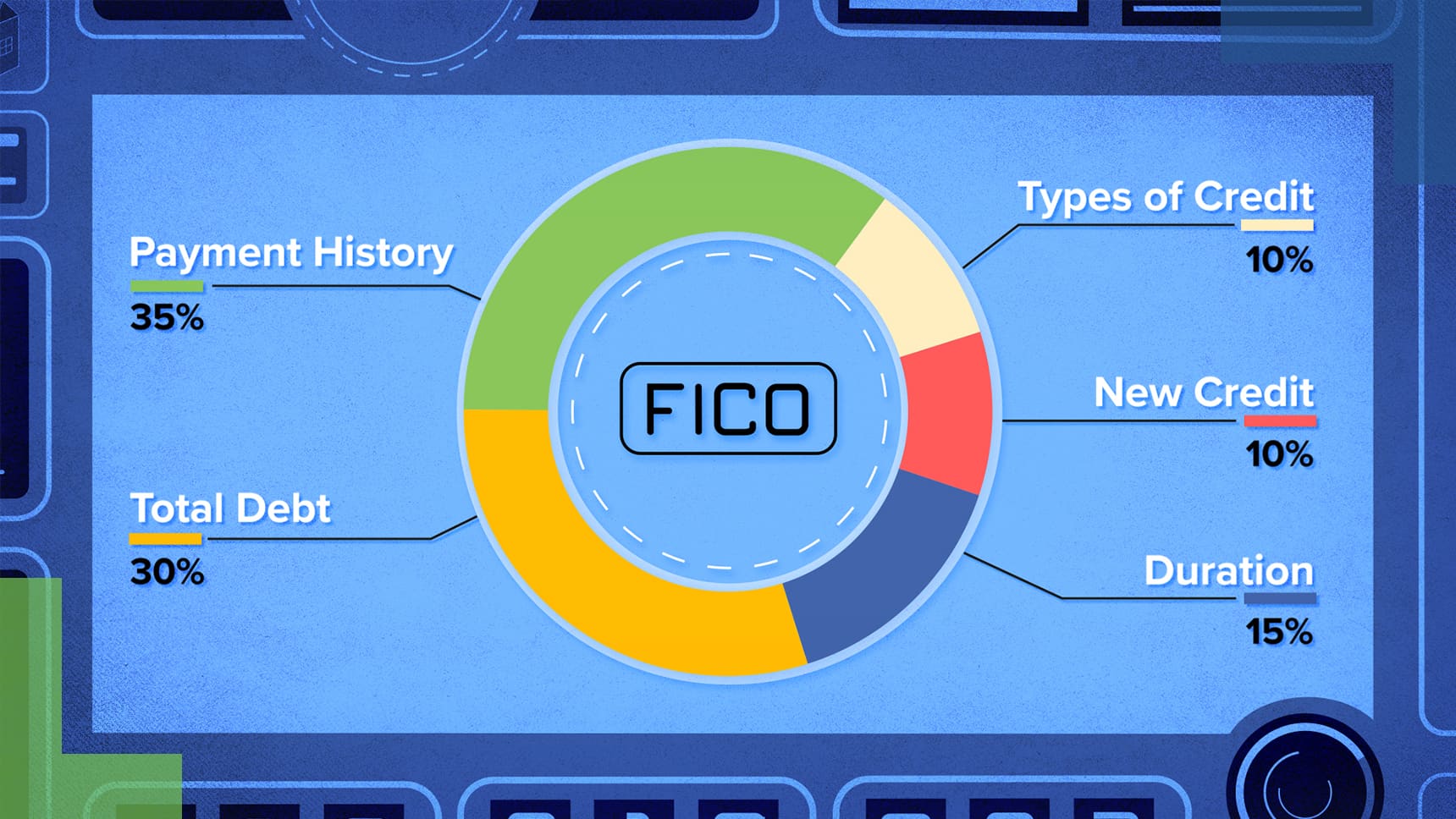

Many lenders use one type of credit score, called the FICO score. FICO — or Fair Isaac Corp. — was the first company to translate all your credit history into a single three-digit number that predicts how likely you are to default on your bills.

The number helps lenders decide how much of a credit risk you are. Watch this video to find out more about your FICO score.

More from Invest in You:

- This key thing could be messing with your tax refund: Tax withholdings

- Josh Brown: How I explain the stock market vs the economy

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

"score" - Google News

January 19, 2021 at 11:13PM

https://ift.tt/2LPUK3T

The average FICO score is 711. Here's what the number means and how you can get a higher rating - CNBC

"score" - Google News

https://ift.tt/2OdbIHo

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "The average FICO score is 711. Here's what the number means and how you can get a higher rating - CNBC"

Post a Comment